Chapter 7 Bankruptcy

Chapter 7 Bankruptcy Information

What Is Chapter 7 Bankruptcy?

What Does Chapter 7 Mean For Me?

What Is The Chapter 7 Means Test?

What Is the Chapter 7 Process?

What Is A Chapter 7 Reaffirmation Agreement?

But, Should I Reaffirm My Car Loan?

What Is An Automatic Stay?

What Happens After A Chapter 7 Bankruptcy?

What Is Chapter 7 Bankruptcy(Straight Bankruptcy)?

In a bankruptcy case under chapter 7, you file a petition asking the court to discharge your debts. The basic idea in a chapter 7 bankruptcy is to wipe out (discharge) your debts in exchange for your giving up property, except for "exempt" property which the law allows you to keep. In most cases, all of your property will be exempt. But property that is not exempt is sold, with the money distributed to creditors. If you want to keep property like a home or a car and are behind on the mortgage or car loan payments, a chapter 7 case probably will not be the right choice for you. That is because chapter 7 bankruptcy does not eliminate the right of mortgage holders or car loan creditors to take your property to cover your debt. If your income is above the median family income in your state, you may have to file a chapter 13 case (the national median family income for a family of 4 in 2006 was approximately $65,796). Higher-income consumers must fill out "means test" forms requiring detailed information about their income and expenses. If the forms show, based on standards in the law, that they have a certain amount left over that could be paid to unsecured creditors, the bankruptcy court may decide that they cannot file a chapter 7 case, unless there are special extenuating circumstances.

What Does Chapter 7 Mean For Me?

If you comply with all of the requirements of a Chapter 7 Bankruptcy, you can get out from under most, if not all of your bills, stop being harassed by Bill Collectors and get your life back together.

If you any or all of the issues below, then Filing a Chapter 7 Bankruptcy can protect you and your family.

What Is The Chapter 7 Means Test?

To comply with Chapter 7 Requirements a Single Debtor and/or a Joint Debtor may only have a certain level of income to be entitled to file for a Chapter 7 Bankruptcy.

Your assigned Georgia Family Law, P.C. Attorney will review your income, assets, and debts and plug them into a Bankruptcy Program that specializes in Bankruptcy and determine whether your situation allows you to file for a Chapter 7 Bankruptcy.

What Is the Chapter 7 Process?

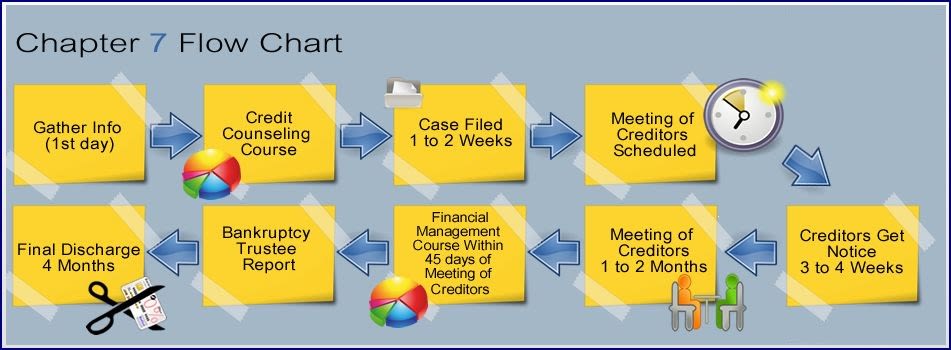

Below is a sample Flow of the steps and timelines for a Chapter 7 Bankruptcy.

What Is A Chapter 7 Reaffirmation Agreement?

Filing bankruptcy has the effect of discharging most debts including obligations on car loans and leases. In a reaffirmation agreement, the debtor voluntarily agrees to remain obligated on a debt that would have otherwise been discharged. In a lease assumption agreement, the debtor agrees to be obligated on the lease.

Under the 2005 Bankruptcy Amendment Act (BAPCPA), if a debtor does not redeem or reaffirm a car loan pursuant to Bankruptcy Code § 524, the lender can eventually repossess the vehicle, because almost all car loan agreements contain boilerplate language that deems bankruptcy as a default under state law, even if the car owner is current with payments. When there is a default, a lender, under state law, can repossess.

But, Should I Reaffirm My Car Loan?

At Georgia Family Law, P.C., we will work with you to determine if Reaffirming a Car Loan or Lease is in your best interest.

In many instances, we can Reaffirm the Loan or Lease on better terms than you originally had.

What Is An Automatic Stay?

The protection of the bankruptcy law known as the "automatic stay" goes into effect immediately upon the filing of a Chapter 7 bankruptcy case. The automatic stay will force all collections activities to stop, including harassing creditor phone calls, collection letters, garnishments, foreclosures, repossessions, and civil lawsuits for debt collection.

A creditor can ask a bankruptcy judge to lift the automatic stay protection with a showing of good reason. The automatic stay remains in effect until it is lifted or until the Chapter 7 bankruptcy case is over and the debt is discharged. If the debt is discharged, the creditors will have no grounds to harass or call the debtor anymore because they now have no debts to collect.

What Happens After A Chapter 7 Bankruptcy?

Having to file for bankruptcy is something we all hope we never have to do in our lifetimes. However, like with other setbacks in life, you can recover. There may be different paths to recovery for each form of bankruptcy, but there is always hope!

You may have done everything you can to avoid bankruptcy but those sweet 0% interest credit cards may have gotten the better of you. Or your health or unemployment issues may have taken center stage in recent years, and you were left with no recourse but to declare bankruptcy. When considering your financial future following such an event, you can expect that trying to secure credit for the next 3 to 5 years is going to be tough. Also, you can expect this negative mark to appear on your credit report for the official length of time of 10 years.

It’s legal for creditors to keep financial events on your report for 10 years, but that’s not a hard and fast rule. So how does bankruptcy actually affect your credit? It does so by lowering your credit score by 200 +/- points (sometimes even more) — usually because of late payments on accounts and not just because you filed for bankruptcy. If you find yourself becoming overwhelmed by payments, then this is an ominous sign. This is one symptom that can eventually lead to serious financial consequences for you if you fail to make any changes to your situation.

Now the good news: if during the bankruptcy proceedings, you decide to reaffirm or keep some of your debt and you continue to take responsibility for these loans (e.g. your car loans or house mortgage), then you may have a shot here (to some degree) to lessen the damage done to your credit score and future credit worth in the eyes of lenders.

Additionally, there will be credit card companies (yes, they are out there) that will solicit you after the bankruptcy. You’ll be debt-free after all, right? Nevertheless, you should certainly be cautious and wary, although you may think of this as a second opportunity to do things the right way. While taking on new credit and applying for a secured credit card can be a way to rebuild your credit history, you’ll have to evaluate just how responsible you can be with handling debt all over again. You’ll need to tread down this road very carefully because if caution is not heeded, your actions could lead you back down the same path towards bankruptcy.